Growth Equity

SRI Quality Growth

Actively managed equity strategy.

Socially responsible investing viewed through a common-sense lens.

Growth Equity

SRI Quality Growth Equity Strategy

Best Ideas portfolio with large cap growth style consistency.

- Focused portfolio of around 30-40 publicly traded high-quality stocks

- High conviction, and low portfolio turnover approach

- Proactive sell-discipline

- “Price follows earnings” philosophy seeks companies with the ability to consistently grow top- and bottom-line earnings

JAG’s experienced, entrepreneurial portfolio management team seeks to add value by curating a portfolio of multinational firms with wide competitive moats, consistent profitability, and strong balance sheets that we believe are not overly reliant on the economic cycle.

Discover The Latest Insights

Stay up-to-date with reports and insights from our analysts and practice leaders.

JAG Growth Equity Thematic Insights: Q1 2025

April 2025 If you're feeling a bit overwhelmed by the tsunami of news so far in 2025 - rest assured, you are not alone. The financial markets have been...

JAG Fixed Income Thematic Insights: Q1 2025

March 2025 - Context on Credit Spreads: Should Investors be Concerned? Summary Our clients routinely ask us to comment on the overall levels and trends in...

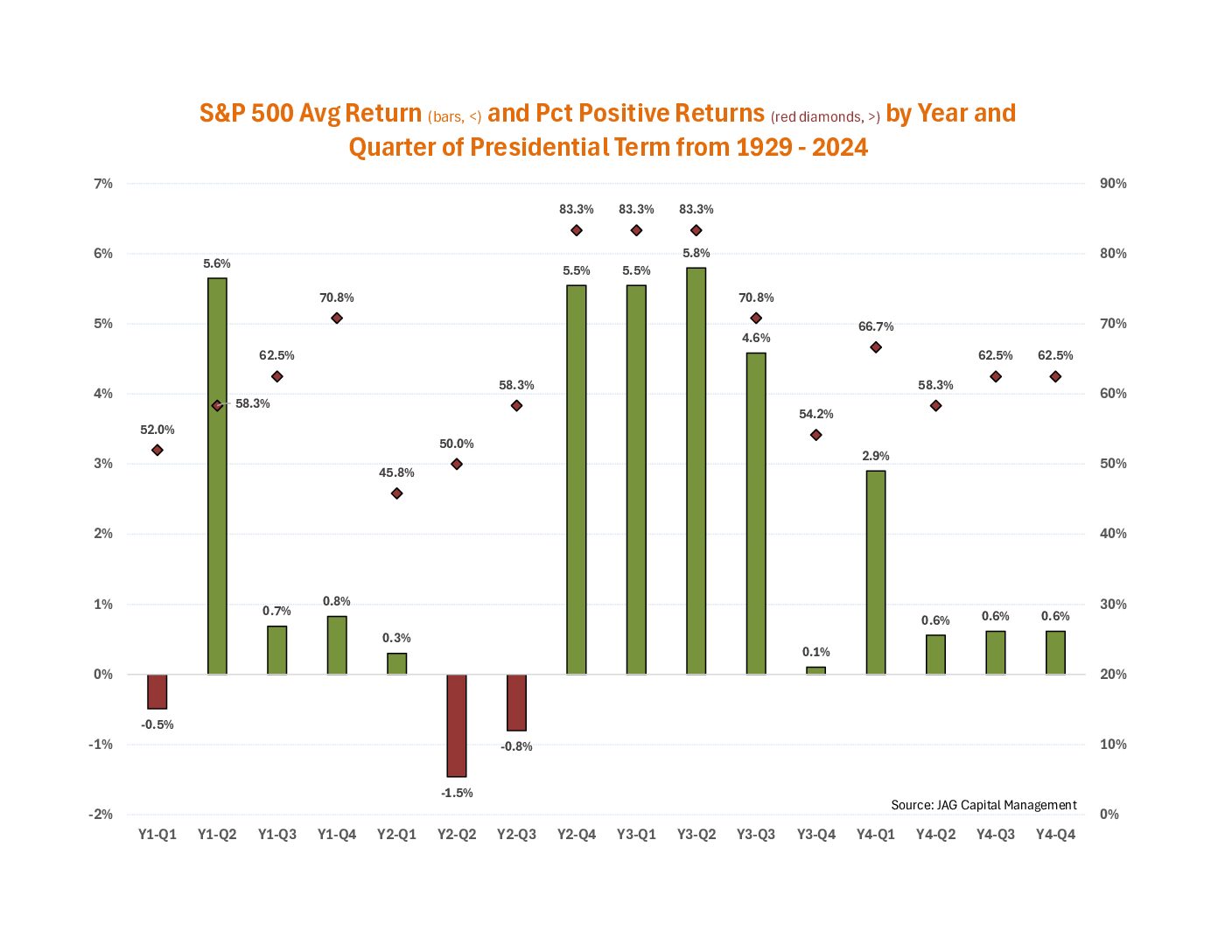

4th Quarter 2024: Back to Back Bulls

Back to Back Bulls The S&P 500 rose to an all-time high in the fourth quarter and extended 2024's gains as the Presidential election (finally!) moved into...

Strive For More with Large Cap Growth

View the Quarterly Fact Sheet for detailed information.