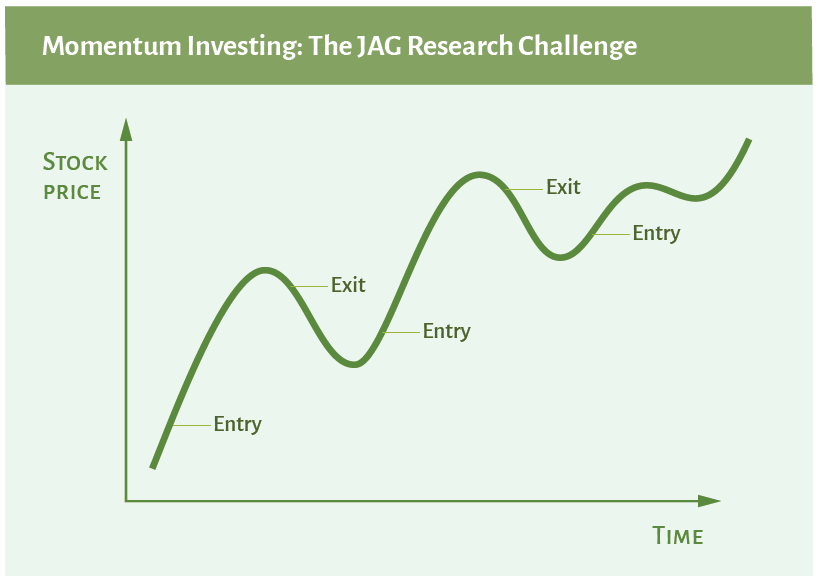

Investment management was probably the last thing Sir Isaac Newton had in mind when he postulated that “an object in motion tends to stay in motion.” But his basic principle of classical physics offers some insightful lessons when it comes to successfully navigating today’s capital markets. In an investment context, momentum describes the tendency of “winners” (i.e. stocks that are appreciating in price relative to their peers) to continue to appreciate further. For this premise to hold true, the offsetting consequence must also be a potential outcome: stocks that have lagged will continue to languish. Again thinking back to Newton’s First Law of Motion, “Objects at rest tend to remain at rest.” When properly constructed, momentum strategies attempt to purchase securities during periods of outperformance, and sell when the security begins to exhibit poor performance. Unlike value strategies, momentum disciplines will rarely (if ever) purchase securities at the “bottom” of a long-term period of declines. Similarly, by their very nature, momentum strategies rarely sell securities exactly at the “top” of a long-term period of price increases. Importantly however, well-managed momentum portfolios can and do generate alpha by establishing and maintaining positions in outperforming securities for as long as their discipline allows.

As a growth-style investment manager, JAG Capital Management believes that its research on momentum style investing and its extremely disciplined portfolio management approach are the keys to successfully identifying stocks that offer long-term capital appreciation potential. Despite all the controversy, misinformation, and misperceptions, the historical track record of momentum outperformance is widely supported by many academics. Simply stated, the benefits of this approach should not be ignored.