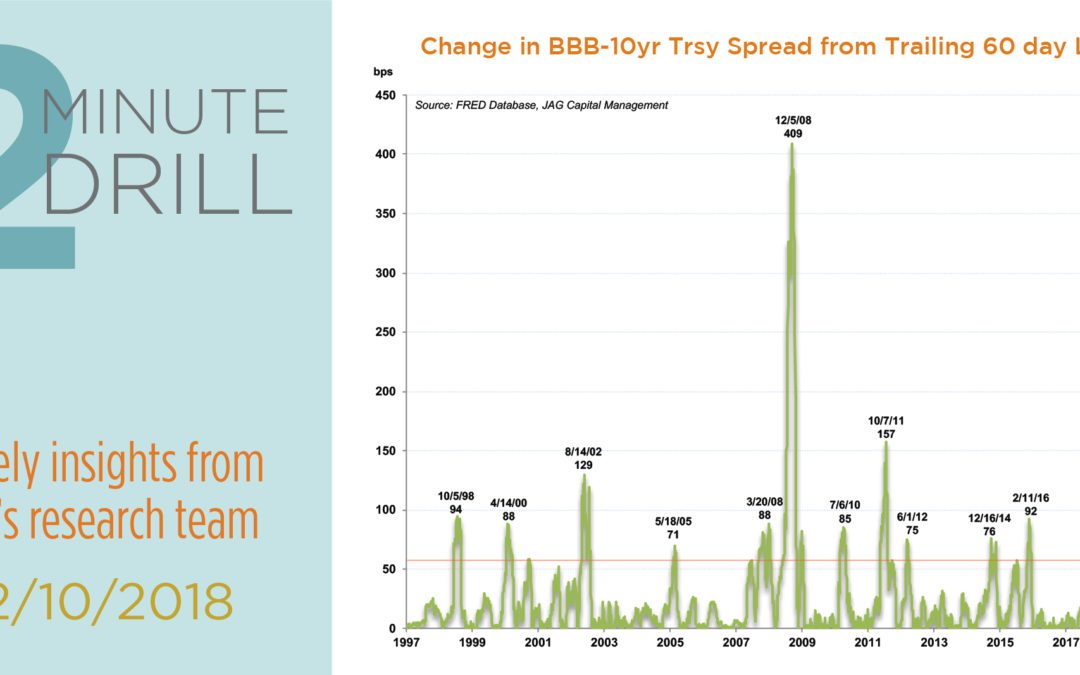

Both bear markets and recessions are often characterized by a tightening of credit conditions, which is manifested in a widening of credit spreads. In other words, when investors fear rises, money gets more expensive for borrowers. As we can see from both charts, spreads have widened over the past couple of months. Compared to 10-year US Treasuries, BBB-rated (the lowest rung of investment grade) bond spreads have risen by 57 basis points from their trailing 60 day low. This is the most-significant widening event for BBB’s since February 2016. Junk bond spreads – shown here by comparing CCC-rated bonds to 10-year Treasuries – have also widened to their highest levels since early 2016. However, as in all things investment-related, context is important. While credit spreads have widened, they are not (at least not yet) near the levels that have signaled deep bear markets or recessions in the past. Until and unless spreads rise significantly more, we think the odds are tilted in the bulls’ favor over the next 6-12 months.